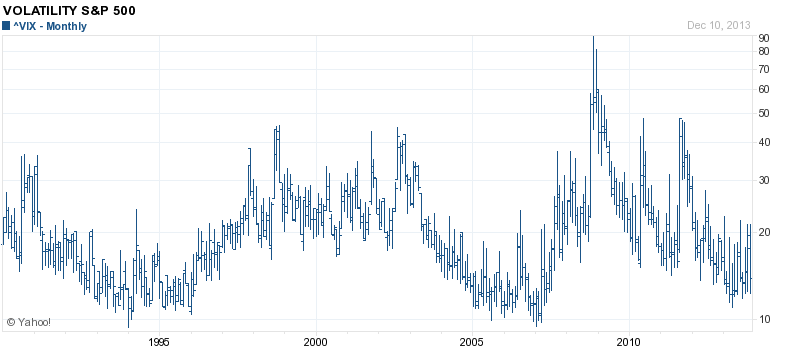

An overbought market that has kept the vast majority of investors and traders in the bull camp for several weeks is to be viewed with suspicion. When prices also begin to lose their upward momentum, they almost always enter a multi-week decline of some degree. The loss of momentum can be seen in a leveling out and decline in RSI, a bottoming out of the VIX, and choppy daily and hourly price action.

All of the above shortly precede actual declines in stock indices, and when used as a group this set of indicators gives few false positives. This should be plain as day to anyone who turns off the financial TV and just looks at the evidence. There’s no sense in calling the top of a bull market, but with the exception of “buy-and-hold-for-life” investors, it’s just plain silly to accept market risk in conditions like these. Those who want to defer capital gains to 2014 might do well to add market hedges to their portfolios.

S&P 500, 1-year (yahoo):

Image may be NSFW.

Clik here to view.

Here are a couple of proxies for sentiment. First the VIX, which indicates complacency when below 15. In fact, the VIX has been suppressed all year, the longest such stretch without a close above 25 since the last bull market top in 2007.

1-year VIX (yahoo):

Image may be NSFW.

Clik here to view.

Long-term VIX (yahoo):

Image may be NSFW.

Clik here to view.

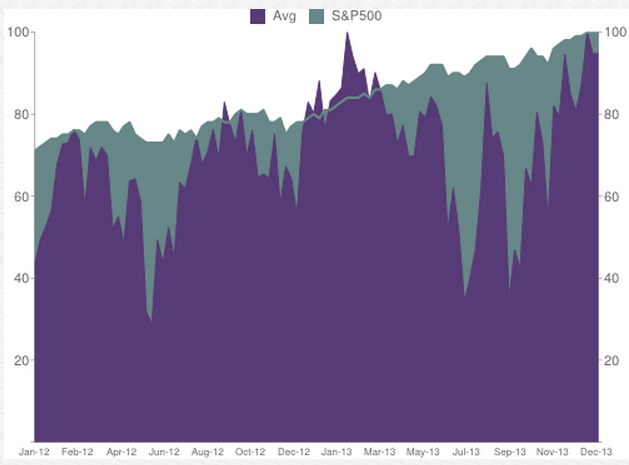

The NAAIM survey of manager sentiment is a relatively new indicator, but it’s freely available online and tracks the more established sentiment surveys like those from Investors’ Intelligence.

2-year chart:

Image may be NSFW.

Clik here to view.

As discovered by John Hussman, elevated Treasury bond prices (higher rates) are another indication of a top in equities when coinciding with stock sentiment and price action.

1-year chart (yahoo):

Image may be NSFW.

Clik here to view.

I want to thank John Hussman for his outstanding historical research and backtesting of innumerable datasets, from which he has distilled a set of indicators which together represents a “syndrome” of elevated market risk (“overvalued, overbought, overbullish, rising yields”). Hussman makes little or no mention of RSI, but I suspect it may bring a greater degree of timing precision, so to my 5-symptom syndrome can be stated as follows: “overvalued, overbought, overbullish, rising yields, declining momentum.”

Happy holidays!

-Michael

The post Top developing appeared first on Michael Ritger's Blog.

Clik here to view.

Image may be NSFW.

Image may be NSFW.Clik here to view.

Image may be NSFW.

Image may be NSFW.Clik here to view.

Image may be NSFW.

Image may be NSFW.Clik here to view.

Clik here to view.